News & Politics

With budget season approaching, Pennsylvania business leaders want a corporate tax cut

Pennsylvania chambers of commerce say a tax cut will attracts businesses and create jobs.

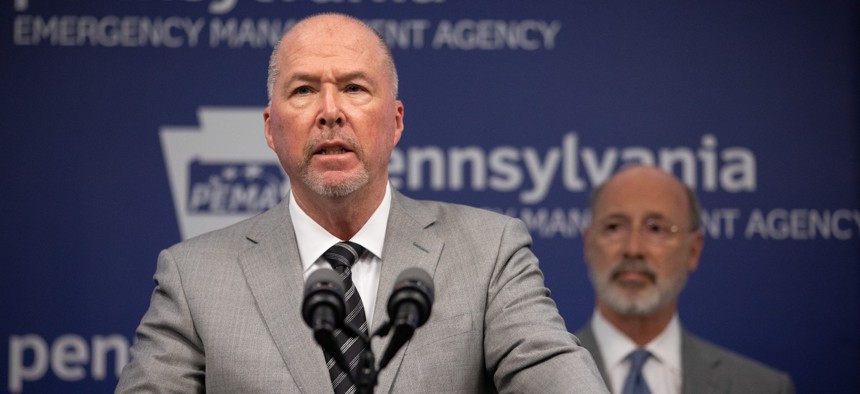

Pennsylvania Chamber of Business & Industry President and CEO Gene Barr Commonwealth Media Services

Business leaders from all corners of the state are putting pressure on members of the General Assembly to pass a “significant reduction” to the state’s corporate tax rate roughly one month out from the state’s June 30 budget deadline.

In a letter sent to state lawmakers this week, nearly 50 chambers of commerce from across the state urged lawmakers to reduce the state’s 9.99% Corporate Net Income Tax rate, which is among one of the highest rates in the country.

“Our excessively high CNI puts us at a competitive disadvantage, acting as a roadblock to attracting new talent and new business opportunities while stifling investment and economic growth,” the chamber leaders wrote.

Lowering the state’s corporate tax rate has long been a priority for Pennsylvania business leaders, with Pennsylvania Chamber of Business & Industry President Gene Barr telling City & State earlier this year that a corporate tax cut is needed to attract businesses and keep workers in the state.

Gov. Tom Wolf, a Democrat, has proposed cutting the state’s Corporate Net Income Tax rate to 6.99%, with a path to getting it down to 4.99% in his most recent executive budget proposal. In past years, Wolf had looked to pair a corporate tax cut with a measure to try and prevent companies from shifting taxes out of the state, but Wolf has so far been unable to garner support for that plan, causing him to drop the effort to enact so-called combined reporting requirements this year.

Lowering the state’s corporate tax rate has widespread, bipartisan support among state lawmakers, with the state House approving a bill to immediately cut the state’s CNIT rate to 8.99%. That legislation passed with a 195-8 vote in April, though it has yet to be taken up in the state Senate.

Wolf’s office appears to favor including other corporate tax code changes in any conversations centered around the state’s Corporate Net Income Tax. “Any changes to the CNIT rate must be discussed as part of a larger modernization of CNIT as proposed by the governor and introduced as HB 2510, which the governor supports and would be more equitable for Pennsylvania businesses while making our state a more attractive place to do business,” said Elizabeth Rementer, a spokesperson for Wolf.

When the dust settles from this year’s round of state budget negotiations, business leaders are hoping that their push for a corporate tax overhaul will have made a difference in Harrisburg – and do so without any other broad tax policy reforms.

“We ask that you help to move our economy in the right direction by supporting a material reduction in the CNI without demanding objectionable tax policy changes that would diminish the benefits of a rate reduction, such as ceding near limitless subjective taxing authority to our Department of Revenue, the business leaders wrote. “We can no longer afford to lose our precious talent and billions of dollars in new business investment to other more competitive states.”