News & Politics

Casey, Fetterman skeptical of $14.9B sale of U.S. Steel

Fetterman vowed to use his position and platform to block the sale.

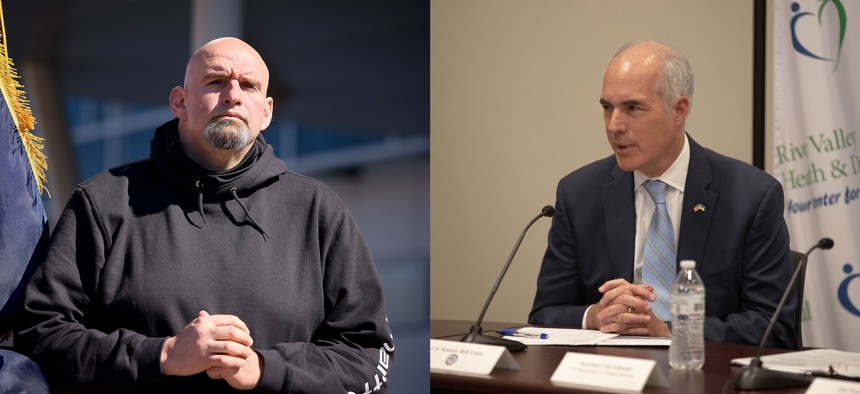

U.S. Sens. John Fetterman and Bob Casey Wikimedia Commons and Commonwealth Media Services

Pennsylvania’s U.S. senators on Monday raised concerns with an agreement between U.S. Steel and the Nippon Steel Corporation that will see Nippon Steel acquire the Pittsburgh-based steel company in a $14.9 billion sale.

In separate statements released on Monday, U.S. Sens. Bob Casey and John Fetterman both critiqued the decision to sell the company to Nippon Steel Corporation, which is Japan's largest steel producer. As a result of the deal, U.S. Steel will remain headquartered in Pittsburgh and all existing collective bargaining agreements in place with its unions will be honored, according to a release from Nippon Steel.

U.S. Steel President and CEO David Burritt said the transaction “combines like-minded steel companies with an unwavering focus on safety, shared goals, values, and strategies underpinned by rich histories.” He added that the move also “benefits the United States – ensuring a competitive, domestic steel industry, while strengthening our presence globally.”

However, Casey and Fetterman remained skeptical of the sale. Casey said in a statement that U.S. Steel should remain under American ownership. “From initial reports, this deal appears to be a bad deal for Pennsylvania and for Pennsylvania workers,” Casey said on Monday. “I’m concerned about what this means for the Steelworkers and the good union jobs that have supported Pennsylvania families for generations, for the long-term investment in the Commonwealth, and for American industrial leadership.”

Fetterman also ripped into the deal, and vowed to use his influence to block the sale to a foreign company. “I live across the street from U.S. Steel’s Edgar Thompson plant in Braddock. It’s absolutely outrageous that U.S. Steel has agreed to sell themselves to a foreign company,” Fetterman said. “Steel is always about security – both our national security and the economic security of our steel communities.”“I am committed to doing anything I can do, using my platform and my position, to block this foreign sale,” Fetterman’s statement continued. He also posted a video on X, formerly known as Twitter, reiterating his pledge.

The sale is subject to both shareholder and regulatory approvals, and is expected to close in the second or third quarter of 2024.